Kicking off with Technological foresight in financial innovation, this topic delves into the exciting intersection of technology and finance, exploring how emerging trends are revolutionizing the way we approach financial services and planning.

From predicting market shifts to optimizing investment strategies, technological foresight plays a crucial role in driving innovation and shaping the future landscape of the financial sector.

Technological Foresight in Financial Innovation

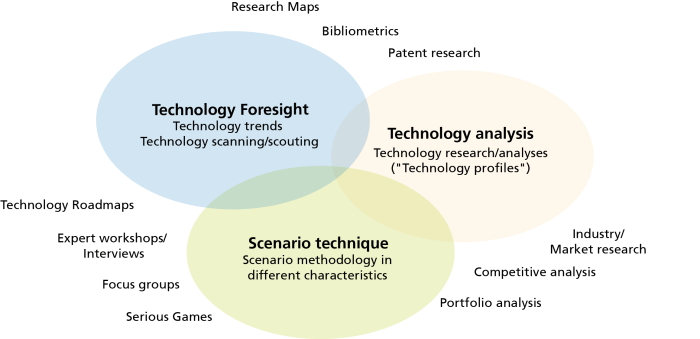

Technological foresight in financial innovation refers to the practice of anticipating and predicting the impact of emerging technologies on the financial sector in order to drive innovation and stay ahead of the curve. By leveraging insights into future technological developments, financial institutions can adapt their strategies, products, and services to meet the changing needs of customers and remain competitive in a rapidly evolving landscape.

The Impact of Emerging Technologies on Financial Services

Emerging technologies such as artificial intelligence, blockchain, and big data analytics are revolutionizing the way financial services are delivered and consumed. AI-powered chatbots are improving customer service, blockchain is enabling secure and transparent transactions, and big data analytics are providing valuable insights for risk management and decision-making.

These technologies are reshaping traditional business models and opening up new opportunities for growth and efficiency in the financial industry.

- AI-powered chatbots are transforming customer service by providing personalized and efficient support to users.

- Blockchain technology is revolutionizing the way transactions are conducted by ensuring security, transparency, and immutability.

- Big data analytics are enabling financial institutions to leverage vast amounts of data to make informed decisions, mitigate risks, and identify new business opportunities.

How Technological Foresight Drives Innovation in the Financial Sector

Technological foresight empowers financial institutions to proactively identify and capitalize on emerging trends and technologies, allowing them to innovate and deliver value-added services to their customers. By anticipating market demands and customer preferences, companies can develop innovative products and solutions that differentiate them from competitors and enhance their market position.

Technological foresight enables financial institutions to stay agile and responsive to changing market dynamics, fostering a culture of innovation and continuous improvement.

Financial Foresight

Financial foresight is the ability to anticipate future trends and developments in the financial industry. It involves analyzing data, market conditions, and emerging technologies to make informed predictions about what might happen in the future. Financial innovation, on the other hand, refers to the creation and implementation of new financial products, services, or processes.

Differentiate between financial foresight and financial innovation

Financial foresight focuses on predicting future trends and developments, while financial innovation involves creating new solutions to address current challenges or opportunities in the financial sector. Foresight helps to inform innovation by providing insights into potential areas for growth or disruption.

Examples of how financial foresight can influence investment decisions

- Anticipating shifts in consumer behavior: By using financial foresight to predict changes in consumer preferences or habits, investors can adjust their portfolios to capitalize on emerging trends.

- Identifying growth opportunities: Financial foresight can help investors identify industries or markets that are likely to experience significant growth in the future, allowing them to make strategic investment decisions.

- Managing risk: By analyzing data and market trends, investors can use financial foresight to assess potential risks and opportunities, helping them make more informed investment decisions.

The importance of integrating financial foresight into strategic planning

Financial foresight is crucial for strategic planning as it enables organizations to prepare for future challenges and opportunities. By incorporating foresight into strategic planning processes, businesses can adapt more effectively to changing market conditions, mitigate risks, and capitalize on emerging trends.

It helps organizations stay ahead of the curve and make proactive decisions that drive long-term success.

Retirement Planning

Retirement planning is a crucial aspect of financial management as individuals prepare for their future financial needs after they stop working. Technological foresight plays a significant role in shaping retirement planning services, offering innovative solutions to help individuals secure their financial well-being during retirement.

Advancements in Financial Technology for Retirement Savings

Advancements in financial technology have revolutionized retirement savings options, making it easier for individuals to plan and save for their future. One key advancement is the development of robo-advisors, which use algorithms to provide personalized investment advice based on individual goals and risk tolerance.

This automated approach to investing can help individuals optimize their retirement savings and achieve their financial objectives.Another significant advancement is the rise of digital retirement platforms that offer easy access to retirement planning tools and resources. These platforms enable individuals to track their savings progress, set financial goals, and make informed decisions about their retirement investments.

By leveraging these digital tools, individuals can take a more proactive approach to retirement planning and ensure they are on the right track to meet their financial goals.

Challenges and Opportunities of AI in Retirement Planning

The use of artificial intelligence (AI) in retirement planning presents both challenges and opportunities. AI-powered tools can analyze vast amounts of financial data to provide personalized recommendations for retirement savings strategies. This can help individuals make more informed decisions and optimize their retirement investments for better outcomes.However, there are challenges associated with the use of AI in retirement planning, such as data privacy concerns and the potential for algorithmic bias.

It is essential for individuals and financial institutions to address these challenges and ensure that AI-driven retirement planning solutions are transparent, secure, and unbiased. By overcoming these challenges, the opportunities presented by AI in retirement planning can lead to more efficient and effective financial management for individuals preparing for retirement.

Succession Planning

Succession planning is a crucial aspect of ensuring the long-term sustainability and success of family businesses. With the advancement of technology, there are now innovative ways to approach succession planning that can greatly impact the smooth transition of leadership within a family business.

Impact of Technological Foresight

Incorporating technological foresight into succession planning can revolutionize how family businesses prepare for leadership transitions. By leveraging digital tools such as predictive analytics, family businesses can gain valuable insights into the future needs of the organization and the capabilities of potential successors.

This proactive approach allows for better decision-making and strategic planning to ensure a seamless transition of power.

- Digital tools can help identify potential successors within the family business by analyzing their skills, experience, and performance data.

- Predictive analytics can forecast future market trends and business challenges, enabling family businesses to groom successors who are equipped to tackle these challenges.

- By using technology to assess the strengths and weaknesses of potential successors, family businesses can create tailored development plans to bridge any skills gaps.

With the right digital tools and predictive analytics, succession planning can be transformed into a strategic process that ensures the continuity and growth of the family business.

Prosperity Point

In the realm of financial management, the concept of a prosperity point refers to a specific juncture where an individual or organization experiences a significant increase in financial well-being. It represents a turning point where financial growth and stability are achieved, paving the way for future success and security.Technological foresight plays a crucial role in identifying prosperity points by enabling individuals and businesses to anticipate upcoming trends, opportunities, and challenges in the financial landscape.

By leveraging data analytics, artificial intelligence, and other cutting-edge technologies, stakeholders can gain valuable insights into market dynamics, consumer behavior, and emerging technologies that can impact their financial prospects.

Leveraging Prosperity Points

One strategy for leveraging prosperity points is to invest in innovative financial products and services that align with emerging trends and consumer preferences. By staying ahead of the curve and adapting to changing market conditions, individuals and organizations can capitalize on new opportunities for growth and expansion.Another approach is to diversify financial portfolios and explore alternative investment options that offer potential for high returns.

This may involve investing in emerging industries, disruptive technologies, or sustainable ventures that have the potential to generate significant wealth over time.Furthermore, strategic partnerships and collaborations with industry leaders, technology providers, and financial experts can help unlock new opportunities and access valuable resources that can fuel financial growth and stability.

By building strong networks and leveraging collective expertise, stakeholders can navigate uncertainties and capitalize on prosperity points for long-term success.Overall, by embracing technological foresight and adopting proactive strategies, individuals and organizations can identify and leverage prosperity points to achieve financial prosperity, resilience, and sustainability in an ever-evolving financial landscape.

Finance and Investing

When it comes to finance and investing, technological foresight plays a crucial role in guiding investment decisions. By leveraging predictive modeling and data analytics, investors can gain valuable insights that can help enhance their investment strategies and improve financial forecasting.

Relationship between Technological Foresight and Investment Decisions

Technological foresight provides investors with a glimpse into the future of financial markets, allowing them to anticipate trends, risks, and opportunities. By staying ahead of technological advancements, investors can make informed decisions that align with the changing landscape of the financial industry.

Predictive Modeling in Investment Strategies

Predictive modeling involves using historical data and statistical algorithms to forecast future outcomes. By applying predictive modeling techniques to investment strategies, investors can analyze patterns, identify potential risks, and optimize their portfolio allocation for better returns.

Role of Data Analytics in Financial Forecasting

Data analytics plays a vital role in improving financial forecasting for investments by processing vast amounts of data to uncover trends and patterns. By utilizing advanced analytics tools, investors can make data-driven decisions, mitigate risks, and seize new investment opportunities in a rapidly evolving market.

Personal Finance

Personal finance is a crucial aspect of everyone’s life, and with the advancement of technology, individuals can now utilize technological foresight for better financial planning and management. Automation has also revolutionized personal finance, making it more efficient and convenient for individuals to track their expenses, savings, and investments.

Additionally, there are various fintech solutions available that cater to personal finance needs, providing innovative tools and services to help individuals achieve their financial goals.

Utilizing Technological Foresight for Personal Financial Planning

Technological foresight allows individuals to analyze market trends, predict future financial scenarios, and make informed decisions about their finances. By utilizing financial forecasting tools and algorithms, individuals can create personalized financial plans that align with their goals and risk tolerance.

This proactive approach to financial planning can help individuals optimize their investments, maximize returns, and secure their financial future.

Impact of Automation on Personal Finance Management

Automation has significantly simplified personal finance management by streamlining processes such as budgeting, expense tracking, and investment management. Personal finance apps and platforms leverage automation to categorize expenses, set up automatic bill payments, and rebalance investment portfolios. This not only saves time but also reduces the margin for error, ensuring accurate financial management and decision-making.

Examples of Fintech Solutions for Personal Finance

1.

Personal Finance Apps

Apps like Mint, Personal Capital, and YNAB offer budgeting tools, investment tracking, and financial goal setting features to help individuals manage their finances effectively.

2.

Robo-Advisors

Robo-advisory platforms like Betterment and Wealthfront use algorithms to provide personalized investment recommendations and optimize portfolio performance based on individual financial goals and risk profiles.

3.

Peer-to-Peer Lending Platforms

Platforms like Lending Club and Prosper enable individuals to borrow or lend money directly to peers, offering competitive interest rates and flexible terms for personal loans and investments.By leveraging these fintech solutions and embracing technological foresight, individuals can take control of their personal finances, make informed decisions, and work towards achieving financial stability and prosperity.

Banking Services

Technological foresight is revolutionizing traditional banking services, leading to a significant transformation in how financial institutions operate in today’s digital age. With the rise of blockchain technology and artificial intelligence (AI), the banking industry is experiencing a wave of innovation that is reshaping the way customers interact with their banks.

Role of Blockchain and AI

Blockchain technology, known for its secure and transparent nature, is playing a crucial role in enhancing banking operations. By enabling decentralized and tamper-proof transactions, blockchain technology is revolutionizing the way banks handle payments, identity verification, and data security. AI, on the other hand, is being used to streamline customer service, personalize banking experiences, and detect fraudulent activities in real-time.

Together, blockchain and AI are empowering banks to deliver more efficient and secure services to their customers.

- Blockchain technology ensures secure and transparent transactions, reducing the risk of fraud and enhancing trust between customers and banks.

- AI-powered chatbots and virtual assistants are improving customer service by providing instant support and personalized recommendations based on individual preferences.

- Machine learning algorithms are helping banks analyze vast amounts of data to identify patterns and detect anomalies, enabling them to prevent and mitigate risks effectively.

Benefits and Challenges of Digital Banking Solutions

The adoption of digital banking solutions offers numerous benefits to both customers and financial institutions. From convenient mobile banking apps to online account management, digital services provide a seamless and accessible banking experience. However, this shift towards digitalization also comes with its challenges, such as cybersecurity threats, data privacy concerns, and the need for continuous technological upgrades.

- Benefits:

- 24/7 access to banking services from anywhere in the world.

- Instant transactions and real-time account monitoring.

- Cost-effective solutions that reduce operational expenses for banks.

- Challenges:

- Cybersecurity risks associated with online banking transactions.

- Data privacy concerns regarding the collection and storage of personal information.

- The need for ongoing training and upskilling of bank employees to adapt to new technologies.

Financial Management

Effective financial management is essential for individuals and businesses to achieve their financial goals. With the advancement of technology, financial management has become more efficient and streamlined. Technological foresight plays a crucial role in enhancing financial management processes by leveraging innovative tools and solutions.

Streamlining Financial Management Processes

Technological foresight allows for the automation of repetitive tasks, such as budgeting, expense tracking, and financial reporting. By utilizing artificial intelligence and machine learning algorithms, financial management software can analyze large volumes of data quickly and accurately, providing valuable insights for decision-making.

- Tools like Mint and Personal Capital help individuals track their expenses, manage budgets, and set financial goals effortlessly.

- Enterprise resource planning (ERP) systems like SAP and Oracle integrate financial management processes across departments, improving collaboration and efficiency.

- Risk management software such as IBM Algo Risk enable businesses to identify and mitigate financial risks proactively.

Role of Machine Learning in Financial Decision-Making

Machine learning algorithms play a crucial role in optimizing financial decision-making by analyzing historical data, identifying patterns, and predicting future trends. These algorithms can help financial managers make informed decisions, reduce risks, and maximize returns.

- Algorithmic trading platforms like QuantConnect use machine learning to analyze market data and execute trades automatically based on predefined strategies.

- Credit scoring models leverage machine learning to assess the creditworthiness of individuals and businesses, streamlining the loan approval process.

- Personal finance apps like Acorns utilize machine learning to provide personalized investment recommendations based on users’ financial goals and risk tolerance.

Tools for Efficient Financial Management

Several tools and software applications are available to aid in efficient financial management, catering to the needs of both individuals and organizations.

- QuickBooks and Xero are popular accounting software solutions that streamline financial reporting, invoicing, and payroll processes.

- Robo-advisors like Betterment and Wealthfront use algorithms to automate investment management and optimize portfolio allocation.

- Blockchain technology enables secure and transparent financial transactions, reducing the need for intermediaries and enhancing efficiency.

Financial Development

Financial development plays a crucial role in the growth and stability of economies around the world. In this section, we will explore the connection between technological foresight and financial sector growth, how innovation in financial technology can drive economic development, and the significance of regulatory frameworks in supporting financial development initiatives.

Technological Foresight and Financial Sector Growth

Technological foresight involves anticipating future trends and developments in technology to gain a competitive advantage. When applied to the financial sector, this can lead to the creation of innovative products and services that cater to evolving customer needs. By leveraging technological foresight, financial institutions can stay ahead of the curve and adapt to changing market conditions, ultimately driving growth in the sector.

Innovation in Financial Technology and Economic Development

The rise of financial technology, or fintech, has revolutionized the way financial services are delivered. By harnessing the power of technology, fintech companies have been able to reach underserved populations, streamline processes, and reduce costs. This innovation not only benefits consumers by providing more convenient and accessible services but also contributes to overall economic development by increasing efficiency and productivity in the financial sector.

Role of Regulatory Frameworks in Supporting Financial Development Initiatives

Regulatory frameworks play a crucial role in maintaining the stability and integrity of the financial system. By establishing clear rules and guidelines, regulators can provide a level playing field for financial institutions to operate and innovate. Moreover, effective regulation can help mitigate risks, protect consumers, and foster trust in the financial sector, thereby supporting financial development initiatives and ensuring sustainable growth.

Profit Paradigm

In the realm of financial innovation, the concept of profit paradigm refers to the fundamental shift in how businesses generate profits, influenced by various factors such as market trends, consumer behavior, and technological advancements. Technological foresight plays a crucial role in shaping profit-making strategies for companies.

By anticipating future technological trends and developments, businesses can adapt their operations to leverage new technologies for increased efficiency, cost savings, and revenue generation. This proactive approach to technological innovation can give companies a competitive edge in the market and drive profitability.

Influencing Profit-Making Strategies

Technological foresight can influence profit-making strategies by guiding companies to invest in emerging technologies that have the potential to disrupt traditional business models and create new revenue streams. For example, the adoption of artificial intelligence (AI) and machine learning algorithms in financial services has enabled companies to automate processes, improve decision-making, and offer personalized services to customers, leading to increased profits.

Examples of Disruptive Technologies, Technological foresight in financial innovation

- Blockchain Technology: The decentralized and secure nature of blockchain technology has transformed the way financial transactions are conducted, reducing costs, increasing transparency, and enabling faster settlement times.

- Fintech Solutions: Financial technology companies have introduced innovative solutions such as mobile payment platforms, robo-advisors, and peer-to-peer lending platforms, disrupting traditional financial institutions and creating new profit opportunities.

- Big Data Analytics: By harnessing the power of big data analytics, companies can gain valuable insights into customer behavior, market trends, and risk management, allowing them to make informed decisions that drive profitability.

Financial Success

In today’s rapidly evolving financial landscape, achieving financial success requires more than just traditional approaches. It involves embracing technological foresight to stay ahead of the curve and maximize opportunities for growth and prosperity.Adapting to technological advancements is crucial for financial prosperity in the modern age.

From automated trading algorithms to digital payment solutions, technology has revolutionized the way we manage and grow our finances. By leveraging these tools and staying informed about upcoming trends, individuals and businesses can position themselves for long-term success.Foresight-driven strategies play a key role in ensuring sustainable financial success.

By anticipating market shifts, regulatory changes, and emerging technologies, individuals can make informed decisions that lead to growth and stability. Whether it’s investing in innovative startups or diversifying portfolios to mitigate risks, foresight empowers individuals to navigate the complexities of the financial world with confidence.

The Role of Technological Foresight in Financial Success

In today’s digital age, technological foresight is a powerful tool for achieving financial success. By staying ahead of trends and embracing innovative solutions, individuals can capitalize on new opportunities and drive growth in their financial endeavors. Technologies such as artificial intelligence, blockchain, and big data analytics are reshaping the financial industry, offering new ways to optimize processes, reduce costs, and enhance decision-making.

By incorporating these technologies into their financial strategies, individuals can unlock new sources of value and create sustainable pathways to success.

Investment Potential

Investment potential refers to the opportunities for growth and profit that can be found in various financial instruments and markets. Technological foresight plays a crucial role in identifying these opportunities by leveraging cutting-edge tools and methodologies to analyze trends, patterns, and emerging technologies.

Role of Big Data in Assessing Investment Potential

Big data has revolutionized the way investment potential is assessed by providing access to vast amounts of information that can be analyzed in real-time. By collecting and processing data from multiple sources such as financial markets, social media, and consumer behavior, investors can gain valuable insights into market trends, risk factors, and investment opportunities.

Big data analytics allows for the identification of correlations and patterns that may not be apparent through traditional analysis methods, enabling investors to make more informed decisions.

- Big data can help identify market trends and opportunities for investment by analyzing large datasets to uncover patterns and correlations.

- By tracking consumer behavior and sentiment through social media and online platforms, investors can gauge market sentiment and adjust their investment strategies accordingly.

- Real-time data analysis enables investors to react quickly to market changes and capitalize on emerging opportunities before competitors.

Predictive Analytics in Enhancing Investment Potential Analysis

Predictive analytics is a powerful tool that uses historical data and statistical algorithms to forecast future trends and outcomes. By applying predictive analytics to investment potential analysis, investors can anticipate market movements, identify potential risks, and optimize their investment strategies for maximum returns.

- By analyzing historical market data and performance metrics, predictive analytics can identify patterns and trends that may indicate future investment opportunities.

- Machine learning algorithms can be used to predict market behavior and assess the potential impact of external factors on investment performance.

- Through scenario analysis and risk modeling, investors can evaluate the potential outcomes of different investment strategies and make informed decisions based on data-driven insights.

Investment Solution

Technological foresight plays a crucial role in the development of innovative investment solutions. By leveraging cutting-edge technologies, financial institutions can create tailored investment options that meet the diverse needs of investors. Robo-advisors and algorithmic trading have significantly impacted the landscape of investment solutions, offering automation and efficiency in portfolio management.

These tools utilize data analytics and machine learning algorithms to make informed investment decisions in real-time, optimizing returns and minimizing risks.

Benefits of Personalized Investment Solutions

Personalized investment solutions driven by technological foresight offer several advantages to investors. These solutions take into account individual risk tolerance, financial goals, and investment preferences, providing a customized approach to wealth management. Through advanced algorithms, investors can access diversified portfolios, rebalancing strategies, and real-time monitoring, enhancing transparency and control over their investments.

Additionally, personalized investment solutions can adapt to market trends and changing economic conditions, ensuring flexibility and responsiveness in managing investment portfolios.

Concluding Remarks

As we wrap up our exploration of technological foresight in financial innovation, it’s evident that staying ahead of the curve is essential for financial success in today’s rapidly evolving digital age. By leveraging cutting-edge technologies and strategic planning, businesses and individuals can navigate the complexities of the financial world with confidence and foresight.

FAQ Explained: Technological Foresight In Financial Innovation

How does technological foresight impact financial innovation?

Technological foresight drives innovation by leveraging emerging technologies to enhance financial services and decision-making processes.

What role does AI play in retirement planning?

AI advancements in financial technology offer opportunities to improve retirement savings options and streamline planning processes.

How can individuals use technological foresight for personal finance planning?

Individuals can utilize technological foresight through automation and fintech solutions to effectively manage their personal finances and investments.